Covid-19 update

Latest info re Financial support tool, short-term absence payments, resurgence support payments, and wage subsidy scheme can be found here

Latest info re Financial support tool, short-term absence payments, resurgence support payments, and wage subsidy scheme can be found here

Government has announced another payment to ease the consequences of COVID-19. The COVID-19 Short-Term Absence Payment is available for businesses, including self-employed people, to help pay their employees who cannot work from home while they wait for a COVID-19 test result. Read more here

Usually, optical coatings either reflect or transmit a particular wavelength, not both. But now, the Rochester researchers have developed a new class of thin optical coatings that can do just that. Another solution in a lab – looking for a practical application. Read more here

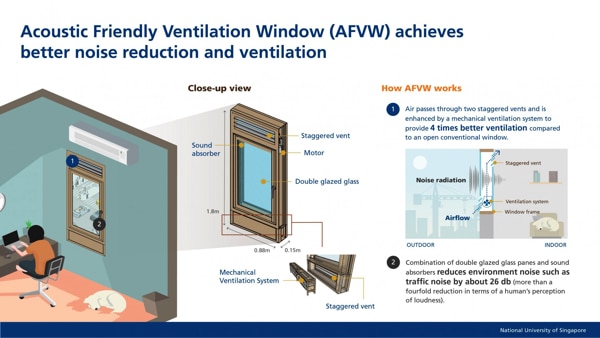

With a staggered vent and mechanical ventilation this window at Singapore University achieves a fourfold reduction in terms of a human’s perception of loudness and achieves four times better ventilation than an open conventional window. Read more here

The first employment law update for 2021 covers a recent employment law decision re Covid-19 pay deductions. Read the detail here

Waitangi Day 2021

This year Waitangi Day falls on Saturday 6 February, and employees who would not otherwise work on that Saturday, get Monday 8 February off on full pay, as Waitangi Day.

Employees who would otherwise work on that Saturday, get that day off on full pay. If they work on that day, they are paid time-and-a-half for the time they worked, and an alternate day off.

New employees qualify immediately – there is no 6-month waiting period like for sick and bereavement leave. Remember that casuals also get public holidays.

Factors to consider if it is not clear whether the employee would have worked on that Saturday, are:

The Government is putting in place support for affected business in case there is a resurgence of COVID-19. Read more here

URGENT Government consulting while NZ is on the beach: Holidays (increasing Sick Leave) Amendment Bill open for submissions until 28 January 2021. Read more here

Read more detail about the new Privacy Act here

Keep up to date – link to detail: